Taxpayer Relief Act 2024 Application – Under the income tax laws, an individual is taxed based on the residential status. A residential status can either be resident or non-resident. Further, a ‘Resident’ is categorised into Not Ordinarily . Act 2023 (the Act) introduced several important changes to Irish tax legislation, including changes to integrate policies that have been driven at an EU and OECD level. We examine the scope of the .

Taxpayer Relief Act 2024 Application

Source : www.wolterskluwer.com

Tax Policy Center on X: “Tax Policy Center estimates show that the

Source : twitter.com

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

Chris Loeffler on X: “This could be great for hotel investing” / X

Source : twitter.com

MBA Announces Support for H.R. 7024, the Tax Relief for American

Source : newslink.mba.org

New IRS 2024 Tax Law Regarding Cryptocurrency Buyers #IRS #Crypto

Source : www.tiktok.com

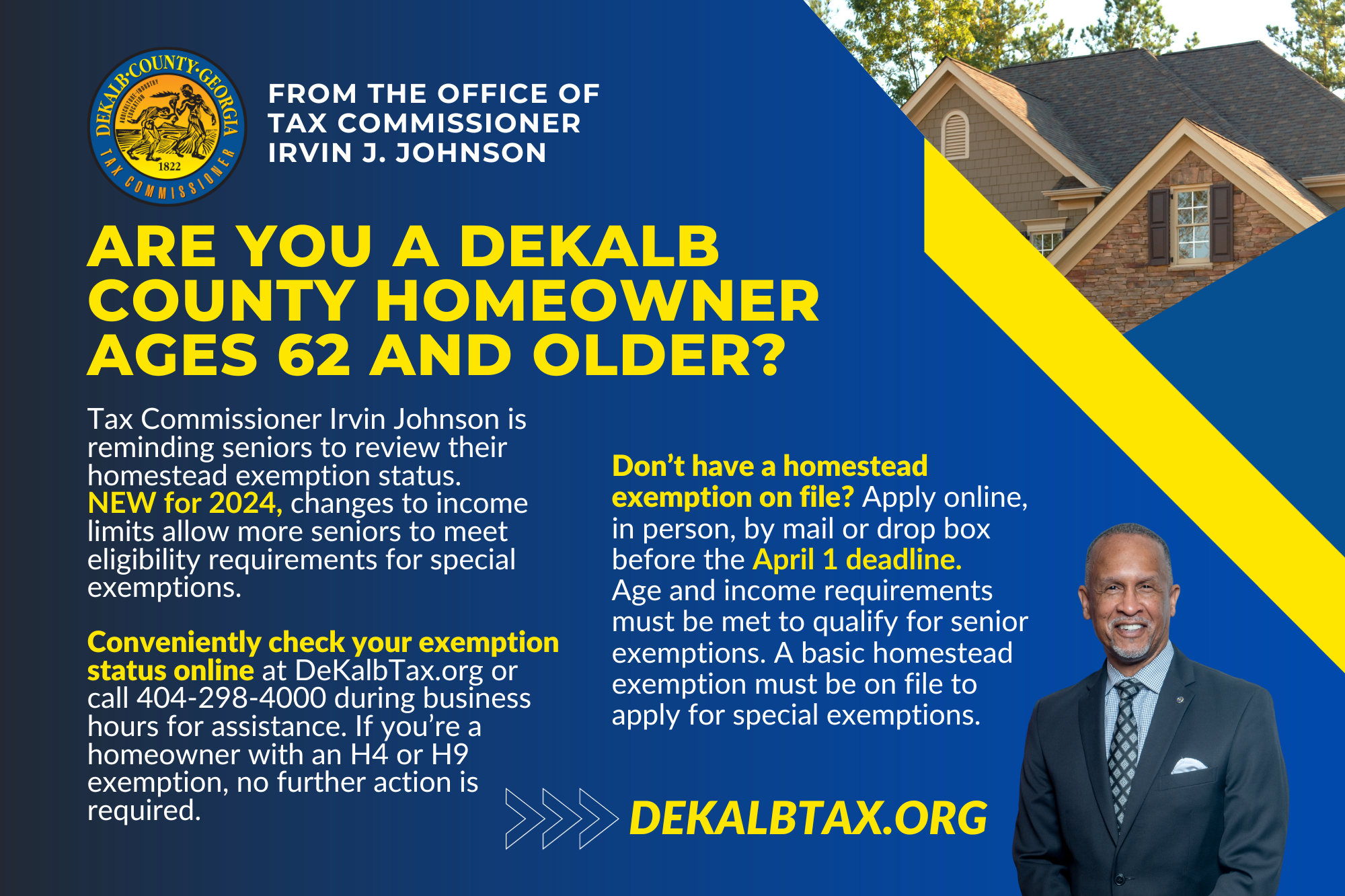

File for Homestead Exemption | DeKalb Tax Commissioner

Source : dekalbtax.org

Tax Policy Center on X: “The Tax Policy Center has analyzed the

Source : twitter.com

Markup of H.R. 7024, the Tax Relief for American Families and

Source : www.youtube.com

Kyle Pomerleau on X: “The bad stuff is hidden in the effective

Source : twitter.com

Taxpayer Relief Act 2024 Application The Tax Relief for American Families and Workers Act of 2024 : Many homebuyers still opt for old tax regime instead of new tax regime because of twin tax benefits. The old tax regime allows homebuyers to claim deduction on the interest paid under Section 24 for . Bill C-208 introduced new intergenerational business transfer rules (“IBT”), which deems the taxpayer and purchaser corporation to be dealing at arm’s length for the purposes of section 84.1 so long .